MuseLetter #346 / December 2021 by Richard Heinberg

Download printable PDF version

Dear Reader,

This Month’s edition consists of two essays—“The End of Growth: Ten Years After” and “Energy Reality for the USA.” As we approach the solstice, and the beginning of a new year, I wish you more opportunities to enjoy the beauty of our amazing little planet. Let’s do what we can to make sure future generations can enjoy it too.

Best holiday wishes,

Richard

The End of Growth: Ten Years After

Fifty years ago the authors of the groundbreaking book The Limits to Growth showed that, in any of a series of computer-generated scenarios, world economic growth would end sometime during the 21st century. Using simple math and logic, they pointed out that growth in any material input or output cannot continue indefinitely within a finite system. Since the Earth is a finite system, the effort to perpetually grow human economies (which, by their very nature, extract resources and produce wastes) is doomed to eventual failure, leading to significant declines in resources, industrial output, food production, and population. Despite the fact that the book was a bestseller and its conclusions were well supported, world political and business leaders ignored it and persevered in their efforts to expand resource extraction, agriculture, and manufacturing.

Around the year 2010, it appeared to me that signs of growth’s slowing and approaching reversal were accumulating to the point that a new book on the subject might be timely and helpful. The End of Growth was published in 2011, and attracted healthy sales but few reviews.

Today, indications of impending economic stagnation and retrenchment are arguably stronger still. There will be many articles this semicentennial anniversary year discussing the 1972 Limits to Growth study; I thought it might also be informative to look back at my book, reflecting on whether its message is useful today.

In the book, I argued that modern economic growth is largely attributable to fossil fuels. Energy is essential to all activity, and the availability of vast amounts of energy from tens of millions of years’ worth of ancient sunlight, captured and transformed by natural processes into portable and storable fuels, has made it possible to speed up and expand nearly every human enterprise. Prior to the widespread use of coal, oil, and natural gas, agrarian societies saw cyclical periods of rise and fall. But the scale of expansion since the dawn of the fossil-fueled industrial revolution, beginning roughly at the start of the 19th century, has been unprecedented. Energy usage per capita has grown 800 percent, as has population. Meanwhile, the contours of society have been transformed: for the first time in human history, most people now live in cities. We have become accustomed to the constant use of powered machinery at work and at home. Growth has become routinized, studied, measured, and institutionalized. Economists now regard it as normal, beneficial, and even essential.

However, the growth of modern fuel-guzzling industrial societies produces two trends that are likely to limit continued expansion: resource depletion (including the depletion of fossil fuels) and pollution (including carbon emissions-driven climate change). It was clear in 2011 that depletion and pollution were imposing costs on society, and that these costs were growing exponentially.

A third limiting factor discussed in my book was the proliferation of unrepayable debt. During industrial expansion, debt seemed to play an advantageous role by enabling companies, governments, and households to consume now and pay later. Debt and credit helped create jobs while increasing corporate profits, returns on investment, and government tax revenues. However, just as debt made the upslope of world economic growth steeper than it otherwise would have been, the existence of enormous pools of debt that will at some point suddenly be revealed as unrepayable could make the end of growth more of a cliff than a gentle downslope.

There are certainly other possible limits on growth—including increasing economic inequality, pandemics, and war—but the three trends I focused on in the book seemed to me, at the time, the ones most likely to tip the scales toward societal decline or collapse.

In 2011, the world was still reeling in the aftermath of the Great Recession of 2008. Central banks and governments were piling on debt at unprecedented rates and keeping interest rates at historically low levels in order to spur more borrowing and more investment, thereby preventing an unraveling of the global industrial and financial systems. Over the short run, the automobile industry was bailed out. In following years, “easy money” policies helped capitalize the fracking boom in the US, which was then just igniting. As a result of the latter, relatively small drilling companies produced enormous amounts of petroleum and gas during the past decade, easing fears of “peak oil.”

Clearly, growth did not end in 2011. China’s GDP clocked in at about 6 trillion US dollars in 2010; today it’s well over twice that size, at 17T$. A decade ago, US GDP stood at 15T$; today it has risen to nearly 23T$. During the same period, world GDP increased from roughly 66T$ to 85T$. In 2010, the world’s annual energy usage stood at about 550 quadrillion BTUs (“quads”); by 2019 (prior to the pandemic—more about that below), that amount had risen to roughly 625 quads.

So, is there more smooth sailing ahead? Let’s look at some important current trends that might make further economic expansion likely or unlikely, easy or difficult.

Fossil fuel supply: During the past decade, 90 percent of world growth in petroleum supply came from US tight oil, the extraction of which is so drilling-intensive that most companies specializing in this resource have relied heavily on debt, with many losing money on each barrel produced. Natural gas, now regarded as a “bridge fuel” to a hypothesized all-renewable energy future, grew both in production levels and as a share of total energy; but an increasing proportion of gas (especially in the US) was produced from drilling-intensive shale reservoirs. Coal usage declined in the US, but saw massive increases in China and India; indeed, a large portion of world GDP growth during the past decade can be attributed to expanded Chinese coal consumption. China burned so much of the fuel that the inevitable peak of global coal production was probably hastened by a few years. This winter, high coal, oil, and natural gas prices suggest the world may be starting to nudge against supply limits. In general, prices are too high to be affordable to consumers, but too low to be profitable for producers, due to the depletion of cheaply produced fuels. Expect more energy price volatility ahead.

Other resource depletion: The scarcity of any particular resource has yet to choke off overall world economic expansion—though concerns are increasingly being raised about agricultural phosphorus. However, one set of depletion issues is especially worth noting. The proposed build-out of solar and wind energy technologies to replace fossil fuels is raising concerns about the supplies of resources needed for making panels, turbines, and batteries. Lithium and copper prices are currently at record highs. While some studies estimate that there are sufficient resources in the ground to enable the construction of the first generation of renewable energy infrastructure at scale, much of that infrastructure will require replacement roughly every 25 years thereafter. Recycling would help avert resource supply issues, but would not entirely solve the problem. Expect severe scarcity later this century of copper, high-grade silica sand, lithium, and a range of other ores and minerals.

Climate change: During the past decade, concern about global warming among scientists, policy makers, and the general public has exploded. Nine of the ten hottest years on record occurred between 2010 and 2020. The costs of severe weather, drought, wildfires, and rising sea levels have soared to an annual level of over $200 billion as of 2020. Estimates of future costs have escalated sharply. However, political leaders appear incapable of addressing the crisis in an effective way, as doing so would require deliberately reining in economic growth—and virtually none of our leaders are prepared to entertain that prospect. According to a recent poll of young people in 10 countries, over half believe that, largely due to climate change, humanity is doomed.

Other pollution: While most news about pollution during the past decade has focused on the great Pacific Ocean garbage patch and on increasingly pervasive plastic particles, an even more frightening trend has to do with the environmental spread of hormone-mimicking chemicals. As a result of these, male sperm counts are plummeting at a rate such that they may reach zero, on average, before 2050. The effect is being seen in both humans and animals. Its implications are truly and deeply shocking. This trend simply wasn’t on my radar in 2011.

Status of wild nature: Recent assessments show that wildlife abundance has fallen by roughly 70 percent in the past 50 years. The trend holds with all major classes of animals, including mammals, birds, reptiles, amphibians, fish, insects, and other invertebrates. Unless something is done soon, humanity will preside over a biological catastrophe that will have repercussions for all of life, and for millions of years to come. The impact on economic growth? You can’t maintain a healthy economy on a dead planet.

Pandemic: The possibility of a global pandemic was not mentioned in The End of Growth. However, as we all know, COVID-19 has had an enormous short-term impact on the global economy and on the lives of billions of people. Its long-term implications are the subject of much speculation. One set of impacts has to do with a reordering of national prospects: countries enjoying high levels of social cohesion got through the pandemic relatively unscathed and are, in many cases, on a more stable path economically and politically; while those (like the US) with already eroding levels of social trust saw cohesion deteriorate still further. Thus, COVID-19 has probably hastened the process of America’s decline as the world’s economic and geopolitical superpower, which was already under way.

Inequality: During the last decade, millions have been lifted out of poverty (as defined by the fairly arbitrary standard of living on $1.90 or less per day), but the disparity between the wealthiest and poorest has worsened, with just a few people today controlling as much wealth as the poorer half of humanity. According to the UN, income inequality has grown starkly within most countries (notably China and the US), with 71 percent of the world’s population living in countries where the gap between rich and poor is widening. Also during the last decade, social research has confirmed in much greater historical detail how increasing inequality contributes to societal instability or collapse, and the rise of authoritarianism. As if on cue, the past few years have also seen a general decline in the quality of democracy within many countries, and an uptick in the number of authoritarian regimes worldwide.

Debt: Today, global debt levels are higher than they were just prior to the 2008 financial crash. Our current financial environment has been called the “everything bubble.” The global debt-to-GDP ratio has grown to about 360 percent, a level economists in the past have called “untenable,” with debt ballooning especially in Japan, the US, and China. Countries have used debt to maintain adequate fossil fuel supplies and to prevent the collapse of their financial systems. But the productivity of new debt (i.e., the increase in GDP resulting from each new dollar of debt) is declining, which suggests that the effort to maintain economic growth by purely financial means is subject to the law of diminishing returns.

In short, leaders of government, finance, and industry seem to have borrowed their way to another decade of economic growth—which was mostly squandered in profit-taking rather than being spent preparing for the societal challenges that the inevitable and fast-approaching termination of growth will entail. It’s now widely acknowledged that the bailouts and debt sprees of the past decade overwhelmingly buoyed up billionaires, while, in terms of wealth and income, nearly everyone else was either treading water or sinking. More recently, a wild card (the pandemic) has thrown the global economy further into disarray, with billionaires again benefitting disproportionately.

Are we at growth’s inflection point yet? I’d prefer not to make a definitive call. It’s astonishing how fast those who benefit most from growth can pass policies and take drastic actions to keep the system going. But it’s fair to say that, as society approaches the crest of the curve, we are experiencing increasing turbulence. Pinpointing the exact moment of peak in world oil production, or economic growth, or population, will best be done in retrospect. The important thing is to understand our overall trajectory.

My 2011 book concisely explained how society got hooked on growth and why expansion will prove temporary. It contained sections on economic history, including a short survey of how the discipline of economics evolved to perpetuate prominent theoretical errors. All of that material is still useful, even if a few other sections—ones focusing on the 2008 crisis and its immediate aftermath—seem a bit dated.

Some of the most helpful parts of the book discuss what we might do to prepare for the end of growth. Advice to individuals included learning to live with less while focusing on building community resilience. For policy makers, suggestions included adopting new economic indicators that track quality of life and environmental integrity rather than GDP.

These and similar suggestions are now more widely discussed. A “degrowth” movement has emerged, mostly in Europe. Kate Raworth’s “doughnut economics” has been featured on National Public Radio. Other heterodox economic ideas that could be useful in adapting to the end of growth, including public banking, modern monetary theory (MMT), and universal basic income (UBI), are debated in universities and occasionally in Congress. Ilhan Omar and others recently proposed the Genuine Progress Indicator Act of 2021 (which Wall Street Journal immediately poo-pooed). All such ideas are still at the fringes of mainstream economic discourse.

If the end of growth was within sight a decade ago, it’s staring us in the face today. The people who enjoy the most social power have shown their inability or unwillingness to make the post-growth downslope more survivable, despite a half-century of warnings. This should come as no surprise: as I reported in my recent book Power: Limits and Prospects for Human Survival, elites tend to benefit from the status quo, and having a lot of social power tends to reduce one’s empathy and perception of risk. As a result, it’s mostly going to be up to the rest of us to prepare for the big shift and to navigate our way toward safety. The end of growth will undoubtedly come with bumps and bruises, but an ending always implies the beginning of something else. In starting to build an economy that prioritizes sustainability and justice, there will be uncountable opportunities to contribute, share, and reconfigure how we go about daily living—and some of those opportunities might just turn out to be deeply fulfilling compared to the rat race of continuous growth.

Thanks to a generous grant from Mobius Foundation, all donations made to Post Carbon Institute through the end of the year will be matched!

Every donor will also get an exclusive link to a conversation I recently had with Nate Hagens and Asher Miller about my book, The End of Growth—and where we are ten years after it was published. With a donation of $25 or more, you’ll also get a free copy of the ebook.

Please make a contribution today. Your support is essential to our work.

With immense gratitude, Richard Heinberg

Energy Reality for the USA

As global leaders struggle to tackle the climate crisis, and as ordinary people worldwide are increasingly whiplashed by high fuel costs, the US government is promising policymakers, industrialists, and investors that there will be decades of growing supplies of fracked oil and natural gas. However, an independent earth scientist with 32 years of experience with the Geological Service of Canada is using the industry’s and government’s own data to show why that’s a dangerous fallacy.

During the past decade, Post Carbon Institute has published a series of reports by earth scientist J. David Hughes on the status of US shale gas and tight oil resources and production (i.e. natural gas and oil that are extracted using hydraulic fracturing, also known as fracking). These reports are remarkable for their technical depth and thoroughness, and are frequently referenced by climate activists, energy investors, and industry insiders. Hughes has provided a necessary counter to the US Energy Information Administration’s (EIA) typically over-optimistic projections, which often echo hyperbolic claims by the industry. Indeed, Hughes’s reports, which address forecasts contained in the widely-cited EIA Annual Energy Outlook, may justify calling him “the people’s shadow EIA.” Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

Should we believe the government barrel counters when they tell us the US will have plenty of oil and gas for decades to come? A lot rides on that question—including climate policy, the economy, and the fate of an array of industries. Lest we forget: energy is essential to everything we do, and fossil fuels supply over 80 percent of the energy the world currently uses. The status of our energy supplies is a top priority both nationally and globally.

Worldwide, the rate of production of conventional oil and gas has been largely stagnant since 2005—except for one bright spot. The burgeoning production of US unconventional shale gas and tight oil has made most of the difference between scarcity and sufficiency, with tight oil supplying roughly 90 percent of production growth in petroleum globally during the past decade; meanwhile, as the world’s top natural gas producer and consumer, the US has been able to expand supplies to the point where it is now a net exporter of the fuel—both by pipeline (to Mexico) and, by LNG tanker, to Europe.

But, as Hughes has noted in each of his reports, tight oil and shale gas are drilling-intensive, given the high production decline rates of new wells. In order to recover the abundance of these fuels that the EIA claims will be there for the taking, between now and 2050 the industry will need to drill something on the order of 700,000 new wells at a total cost of over $5 trillion. (Hughes calculated 643,105 wells, at a cost of $4.36T, would need to be drilled to meet the EIA’s 2050 forecast for tight oil and shale gas within the plays he analyzed in his report; some additional production would come from other plays, elsewhere in the US.)

Will that happen? For purely geological reasons, it is exceedingly unlikely (see the report for details); but, even if it could, the financial hurdles and environmental impacts would be daunting and frightening. On average, each of those wells would be several thousand feet vertically and over a mile horizontally in length, would use up to 20 million gallons of water and 20 million pounds of proppant (a well in Louisiana used 50 million pounds of proppant), and would produce localized pollution as well as massive carbon emissions.

Meanwhile, is there possibly something better we could do with five trillion dollars? Just by way of example, that’s enough money to pay for 25 solar panels and a heat pump (for indoor heating and cooling) for every housing unit in the US, with hundreds of billions of dollars left over for other social or environmental programs.

Let’s sample some of Hughes’s latest findings in a bit more detail. With regard to tight oil, six of the seven main plays have peaked in production and, without a significant increase in drilling rates, are in permanent decline. Five of these were producing at 15.7% to 40.6% below peak levels as of July 2021. This is partly the result of a reduction in drilling rates due to the COVID-19 pandemic, but in some of the plays (such as the Bakken in North Dakota) it is mostly due to depletion, with future production unlikely ever to exceed the already-achieved peak.

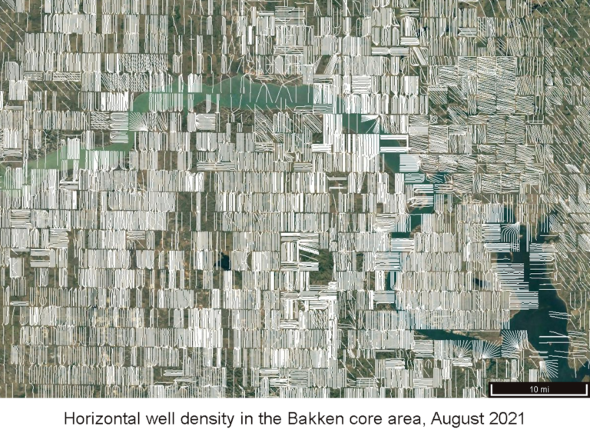

Take a look at this map of horizontal oil well traces in the core area of the Bakken. Do you see room for many more such wells? Apparently the industry doesn’t. Drilling rates and investment were already down prior to the pandemic. Yet the EIA somehow believes that the Bakken still holds vast untapped resources that can be produced over the next 30 years—with much more still to come even then.

A few years ago, it was widely expected (and not just by the EIA) that the country’s seven primary tight oil plays would produce bountifully for a long time to come. But now most of the action is restricted to the large Permian Basin region of northwest Texas and southeast New Mexico. It encompasses a spectacular set of plays. But even here, when carefully examining the statistics for the Spraberry, Wolfcamp, and Bone Spring plays, which together account for the lion’s share of Permian production, Hughes rates EIA expectations for the future as “optimistic to highly optimistic.”

Over all, tight oil production is down over 12% since the start of the pandemic. With continued high oil prices, lots of investment, and a ferocious pace of drilling, production levels could increase again. But to assert, as the EIA does, that the boom will continue for thirty years or more at higher production levels than today, is, to use Hughes’s carefully chosen terms, “highly optimistic.”

With regard to shale gas, the story is similar. Five of the six main plays have peaked and were producing at 12% to 66% below peak levels as of August 2021. Two of these, the Barnett and Fayetteville, peaked in 2011 and 2012, respectively, and are in terminal decline with production more than 60% below peak rates. Hughes writes: “Whether or not the other three, where production is down between 11.9% and 20.3%, can exceed their peak production rates with more drilling, as forecast by the EIA, remains to be seen.”

Again, with high prices, investment, and higher drilling rates, shale gas production can still grow in some regions, such as the Marcellus play in America’s Northeast. But the EIA’s expectations are rated as “moderately to highly optimistic” on a play-by-play basis.

Hughes uses polite, scientific language and lets the numbers speak for themselves. But those numbers tell a tale that everyone should find riveting.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization—and the lives of our children and grandchildren—on energy resources that are depleting and polluting. And our public agencies, tasked with keeping track of these resources, have chosen to offer, in Greta Thunberg’s words, “fairy tales of economic growth” instead of a sober assessment of what lies in store. They have failed to prepare our society for the end of cheap fossil energy, and many people will suffer as a result.

David Hughes, working for the last decade from a modest home on a beautiful island off the coast of British Columbia, has done what dozens of well-paid Washington agency analysts have failed to do—tell us the truth about America’s last fossil-fueled hurrah. He has put plain numbers in front of politicians and the public with no motive other than a dim hope that rationality can prevail. Hughes deserves hearty thanks from all who have benefited from his generous and expert work.

Photo by Gemma Evans on Unsplash

![[Power book cover]](https://richardheinberg.com/wp-content/uploads/2021/03/cover_POWERcatalog-proof_300x450.jpg)