MuseLetter #291 / August 2016 by Richard Heinberg

Download printable PDF version here (PDF, 236 KB)

This month’s Museletter begins with an edited excerpt of an article I wrote for Pacific Standard Magazine called ‘Is the Oil Industry Dying?’ which looks at the current state of the oil industry and how that relates back to the concept of peak oil. Also included this month is “You Can’t Handle the Truth!” a blog post written immediately after the Republican and Democratic national conventions.

Is the Oil Industry Dying?

The ‘peak oil’ controversy is staging a come-back as the industry confronts higher costs—and low prices

Excerpt published by permission, full text at Pacific Standard Magazine.

Talking about “peak oil” can feel very last decade. In fact, the question is still current. Petroleum markets are so glutted and prices are so low that most industry commenters think any worry about future oil supplies is pointless. However, the glut and price dip are hardly indications of a healthy industry; instead, they are symptoms of an increasing inability to match production cost, supply, and demand in a way that’s profitable for producers but affordable for society. Is this what peak oil looks like?

When prices are high enough to generate profits (which is very high indeed these days), they are also high enough to destroy demand.

Aside from forecasts regarding the timing of the inevitable moment when petroleum production would max out (yes, many of those forecasts proved premature), the peak oil discussion more importantly highlighted three key insights, all of them as valid now as ever:

1. Oil is essential to the modern world. Energy is what enables us to do anything and everything, and oil is currently the world’s primary energy source. But oil’s role in society is even more crucial than that sentence might suggest. Nearly 95 percent of global transport is oil-powered, and if trucks, trains, and ships were to stop running the global economy would grind to a halt almost instantly. Even electricity (which is the other main energy pillar of commerce and daily life) depends on oil: coal mining, transport, and processing depend on oil; much the same is true for natural gas, uranium, and the components of solar panels and wind turbines.

2. Oil is hard to substitute. A colleague, the energy analyst David Fridley, and I recently finished a year-long inquiry into details of the necessary and inevitable transition from fossil fuels to renewable sources of energy. While lots of sunshine and wind are available, not all the ways we use energy will be easy to adapt to renewable electricity. Some of the biggest challenges we identified are in the transport sector. Electric cars are certainly feasible (more are on the road every year), but batteries alone can’t power heavy trucks, container ships, and large airplanes.

There are other possibilities (including biofuels and hydrogen-based fuels made using electricity), but these are likely to be much more expensive and will require large energy inputs for their ongoing production. Moreover, transitioning to them will take major investment and infrastructure build-out occurring over two or more decades.

3. Depletion of oil (and of other non-renewable resources) tends to follow the low-hanging fruit principle. Humanity has been extracting oil on an industrial scale for 150 years now. At first, all it took was identifying places where petroleum was seeping to the ground surface, then digging a shallow well. Today, globally, millions of old conventional oil wells lie depleted and abandoned. The primary remaining prospects for production include heavy oil (which requires expensive processing); bitumen (which must be mined or steam-extracted); tight oil (produced from low-permeability source rocks, which requires hydrofracturing and horizontal drilling, with typical wells showing a rapid decline in output); deepwater oil (which entails high drilling and infrastructure costs); or arctic oil (which has so far mostly proven cost-prohibitive). All of these options entail rapidly growing environmental costs and risks.

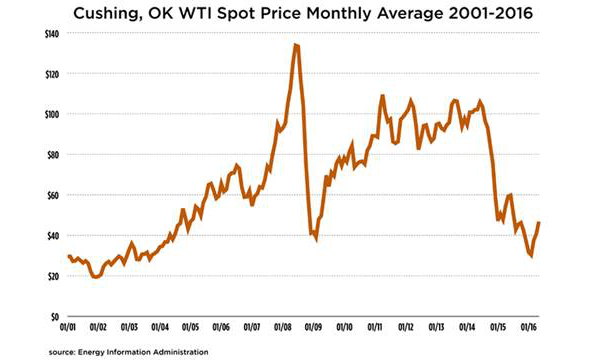

It’s that third point that helps explain the disturbing recent evolution of the petroleum world. Most industry analysts focus on oil prices, and it’s clear on this score that the market has gone seriously weird in recent years. In 2001, petroleum sold for about $20 a barrel, a price that sat well within a fairly narrow band of highs and lows that had bounded price for roughly 20 years following the politically generated oil shocks of the 1970s. But, by the summer of 2008, the price had ascended to the unprecedented, dizzying altitude of $147; then (following the cratering of the global economy) it plummeted to $37. Following that, prices gradually recovered to around $100, where they remained for nearly three years before sliding again, starting in mid-2014, to the high $20s, from which they have partially rebounded to today’s approximately $40.

The recent highs (above $100) are incomprehensible, until we recognize that the oil industry’s costs of production have skyrocketed in the past decade. Throughout the first decade-and-a-half of the new century, demand for oil was growing rapidly in Asia. Normally, the industry would have simply ramped up its supplies of conventional crude to satisfy the needs of new car buyers in China and India. But output of conventional oil topped out in 2005; all the new supply growth since then has been from hard-to-reach or low-grade resources. Producers didn’t resort to these until demand outstripped supply, raising prices and justifying the far higher rates of investment that are required per unit of new production. But that meant that, henceforth high prices would have to continue if producers were to turn a profit.

When oil was selling for $100 per barrel, many tight oil projects in the United States were nevertheless only marginally profitable or were actually money losers; still, with interest rates at historic lows and plenty of investment capital sloshing around the financial industry, drillers had no trouble finding operating capital (David Hughes of Post Carbon Institute was one of the few analysts who questioned the durability of the “shale gale,” on the basis of meticulous well-by-well analysis). The result of cascading investment was a ferocious spate of drilling and fracking that drove levels of U.S. oil production sharply upward, overwhelming global markets. The amount of oil in storage ballooned. That’s the main reason prices collapsed in mid-2014—along with Saudi Arabia’s insistence on continuing to pump crude at maximum rates in order to help drive the upstart American shale-oil producers out of business. The Saudi gambit mostly succeeded: Small-to-medium-sized U.S. producers are now gasping for air, and, as their massive debts come due over the next few months, a wave of bankruptcies and buyouts seems fairly inevitable. Meanwhile, in the continental U.S., oil production has dropped by 800,000 barrels a day.

It might not be far from the mark to suggest that we are witnessing the early stages of the thermodynamic failure of global industrial society.

Indeed, the entire petroleum business is currently in deep trouble. Countries that rely on crude oil export revenues are facing enormous budget deficits, and in some cases are having trouble maintaining basic services to their people.

The worst instance is Venezuela, where hunger is rampant. But hard times have also fallen on Nigeria, the Middle Eastern monarchies, Russia, and even Canada to some degree. The oil majors (Exxon, Shell, Chevron, etc.) are still somewhat profitable because a significant portion of their output still comes from older, giant oilfields; but a large and increasing segment of their remaining profits now goes toward debt servicing. And their existing oil reserves are not being replaced with new discoveries.

Any way you look at it, the industry faces a grim future. Even if prices go up, there is no guarantee of recovery: Investors may be shy to rush back to oil since they have no assurance that a price rout won’t recur in months or years. After all, when prices are high enough to generate profits (which is very high indeed these days), they are also high enough to destroy demand—which is also vulnerable to recessions, the growth of the electric vehicle market, and meaningful climate policy. It’s simply unclear whether the global economy can consistently support an oil price that’s sufficiently robust to pay the industry to extract and refine the kinds of resources that remain.

Again, most oil commentators look at all of this through a purely economic lens. But it may be helpful to think more in terms of thermodynamics. Oil, after all, is primarily useful as a source of energy. And it takes energy to get energy (it takes energy to drill an oil well, for example). Energy profits from oil extraction activities were once enormous, and those energy profits got spread throughout society, wherever oil was used. Now, petroleum’s energy profitability is falling fast.

For example, while conventional oil wells 50 years ago often had a hundred-to-one energy payback, today’s bitumen production in Canada shows an energy-return-on-energy-invested (EROEI) ratio of between 3:1 and 5:1. This declining energy profitability is why it’s now so hard to produce oil at a financial profit, and also why—even when oil supplies are still expanding—they don’t fuel as much economic growth throughout the economy.

Since oil is the key energy source of modern civilization, the effective EROEI of society as a whole can be said to be declining. It might not be far from the mark to suggest that we are witnessing the early stages of the thermodynamic failure of global industrial society. An earlier phase of the process manifested in the financial crash of 2008; when that occurred, governments and central banks responded by deploying easy money (massive debt, low interest rates) to prop up the system, and this temporarily masked society’s dwindling EROEI. Debt can accomplish this over the short run: Money is effectively a marker for energy, and we can borrow and spend money now on costly energy with the promise that we will pay for it later (hence the massive build-up of debt in the oil industry). But if cheaper-to-produce energy and higher prices don’t emerge soon, those debts will eventually become transparently unrepayable. Hence what is inherently an energy crisis can appear to most observers to be a debt crisis.

The problem of eroding energy profitability is hard to deal with partly because the decline is happening so fast. If we had a couple of decades to prepare for falling thermodynamic efficiency, there are things we could do to soften the blow. That’s what the peak oil discussion was all about: It was an effort to warn society ahead of time. Once the dynamic of declining energy profitability really gets rolling, adaptation becomes much more difficult. Oil no longer provides as much of a stimulus to the economy, which just can’t grow as it did before, and this in turn sets in motion a self-reinforcing feedback loop of stagnating or falling labor productivity, falling wages, falling consumption, reduced ability to repay debt, failure to invest in future energy productivity, falling energy supplies, falling tax revenues, and so on. How long can debt continue to substitute for energy before the next traumatic phase of this feedback process begins in earnest? That’s anybody’s guess, but our time-window for action is likely months or years, not decades.

What could world leaders do about declining societal EROEI if they took the crisis seriously? Clearly, part of their strategy would entail building alternative energy supply infrastructure—which must be low-carbon, since we also face the existential threat of climate change. Indeed, some environmentalists say peak oil is a non-issue because whatever we do to tackle climate change will simultaneously solve our oil dilemma. I’m not so sure about that. Most proposed climate mitigation strategies start with transitioning the electricity sector to solar and wind power, and then proceed with a gradual electrification of other energy usage (electric cars, electric air-source heat pumps to heat buildings, etc.). But, as noted, much of the transport sector is hard to electrify. It’s nice to see more Nissan Leafs, Teslas, and Chevy Volts on the road, but those carry people; our real challenge is moving all the stuff we need (food, raw materials, and manufactured goods of all kinds), and that stuff outweighs passengers by an order of magnitude and currently travels mostly by ship and truck.

Efforts now underway to power trucking and shipping renewably are woefully insufficient. Peak oil demands that we focus on transport now, not later: We should supply substitute renewable fuels where absolutely needed, but we must also quickly and substantially reduce our reliance on long-distance transport through economic re-localization.

Much as I hate to think so, thermodynamic decline and economic contraction could seriously impair our chances for a robust renewable energy transition in response to the threat of climate change. Building enough solar panels and wind turbines, and adapting the ways we use energy (in building heating, in industrial processes, in transportation, in food systems, and on and on), will take time and many trillions of dollars of investment. It will also require stable international markets and supply chains, and those could be thrown into turmoil by the declining thermodynamic profitability of our society’s current primary energy source—unless we can somehow build a bridge to the future while the highway we’re on is crumbling beneath us.

The subject of peak oil has been discredited following a short-term oil supply glut and low oil prices. Even many environmentalists have filed peak oil under “Things Not to Worry About.” (One high-level climate campaigner of my acquaintance has said that peak oil is a lousy issue to organize around—as though we can afford to ignore a gargantuan problem if it offers insufficient fundraising potential). Thankfully, that small, resourceful audience has taken action anyway, in the form of community resilience-building efforts that often fly under the banner of Transition Initiatives and similar networks.

It may be counterproductive even to use the phrase “peak oil” today, though I’ve done so in this essay. After all, we don’t know if the actual maximum in world oil output occurred last year, or will happen this year, next year, or several years from now. This lack of definitive predictive power is the Achilles’ heel of an otherwise useful term. What instead should we call the complex, interrelated set of developments described above? Should we dub it “the thermodynamic collapse of industrial civilization”? That has a nice techno-apocalyptic ring to it and is probably more accurate. But it has too many syllables and requires too much background explanation. Only geeks could ever get it.

Something is happening here, whether we have a snappy buzzword for it or not. And we can’t afford to ignore it, regardless how hard it is to explain it to economists, policymakers, and even many environmentalists. My colleagues and I keep trying to do just that. But at this point it also makes sense to batten down the hatches and build resilience close to home.

“You Can’t Handle the Truth!”

Movie buffs will recognize this title as the most memorable line from “A Few Good Men” (1992), spoken by the character Colonel Jessep, played by Jack Nicholson (“You can’t handle the truth!” is #29 in the American Film Institute’s list of 100 top movie quotes).

I hereby propose it as the subtext of the recently concluded Republican and Democratic national conventions.

At this point most people appear to know that something is terribly, terribly wrong in the United States of America. But like the proverbial blind man describing the elephant, Americans tend to characterize the problem according to their economic status, their education and interests, and the way that the problem is impacting their peer group. So we hear that the biggest crisis facing America today is:

- Corruption

- Immigration

- Economic inequality

- Climate change

- Lack of respect for law enforcement

- Institutionalized racism

- Islamic terrorism

- The greed and recklessness of Wall Street banks

- Those damned far-right Republicans

- Those damned liberal Democrats

- Political polarization

The list could easily be lengthened, but you get the drift. Pick your devil and prepare to get really, really angry at it.

In reality, these are all symptoms of an entirely foreseeable systemic crisis. The basic outlines of that crisis were traced over 40 years ago in a book titled The Limits to Growth. Today we are hitting the limits of net energy, environmental pollution, and debt, and the experience is uncomfortable for just about everyone. The solution that’s being proposed by our political leaders? Find someone to blame.

The Republicans really do seem to get the apocalyptic tenor of the moment: their convention was all about dread, doom, and rage. But they don’t have the foggiest understanding of the actual causes and dynamics of what’s making them angry, and just about everything they propose doing will make matters worse. Call them the party of fear and fury.

The Democrats are more idealistic: if we just distribute wealth more fairly, rein in the greedy banks, and respect everyone’s differences, we can all return to the 1990s when the economy was humming and there were jobs for everyone. No, we can do even better than that, with universal health care and free college tuition. Call the Democrats the party of hope.

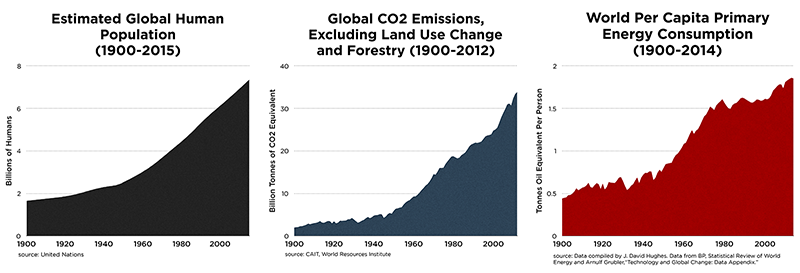

But here’s the real deal: a few generations ago we started using fossil fuels for energy; the result was an explosion of production and consumption, which (as a byproduct) enabled enormous and rapid increase in human population. Burning all that coal, oil, and natural gas made a few people very rich and enabled a lot more people to enjoy middle-class lifestyles. But it also polluted air, water, and soil, and released so much carbon dioxide that the planet’s climate is now going haywire. Due to large-scale industrial agriculture, topsoil is disappearing at a rate of 25 billion tons a year; at the same time, expanded population and land use is driving thousands, maybe millions of species of plants and animals to extinction.

We extracted non-renewable fossil fuels using the low-hanging fruit principle, so that just about all the affordable petroleum (which is the basis for nearly all transport) has already been found and most of has already been burned. Since we can’t afford most of the oil that’s left (either in terms of the required financial investment or the energy required to extract and refine it), the petroleum industry is in the process of going bankrupt. There are alternative energy sources, but transitioning to them will require not just building an enormous number of wind turbines and solar panels, but replacing most of the world’s energy-using infrastructure.

We have overshot human population levels that are supportable long-term. Yet we have come to rely on continual expansion of population and consumption in order to generate economic growth—which we see as the solution to all problems. Our medicine is our poison.

And most recently, as a way of keeping the party roaring, we have run up history’s biggest debt bubble—and we doubled down on it in response to the 2008 global financial crisis.

All past civilizations have gone through similar patterns of over-growth and decline. But ours is the first global, fossil-fueled civilization, and its collapse will therefore correspondingly be more devastating (the bigger the boom, the bigger the bust).

All of this constitutes a fairly simple and obvious truth. But evidently our leaders believe that most people simply can’t handle this truth. Either that or our leaders are, themselves, clueless. (I’m not sure which is worse.)

Hence the political primaries generated lots of feelings (anger, hope, fear), but revealed or conveyed almost no understanding of what’s actually going on, what’s in store, or what to do about it.

Now, I’m not proposing that the two parties are equivalent. There are some substantive differences between them. And in dangerous times, hope usually yields better outcomes than fear and rage (though hope is vulnerable to disillusionment and recrimination, which in turn lead back to fear and rage). Some of the Democrats’ ideas may help as we embark on our Great Slide down the steep slope of the Seneca cliff: for example, a universal basic income (not in the Democratic Party’s platform but consistent with its ideals) could provide a temporary safety net as the economy enters its inevitable long nosedive. Democrats at least acknowledge the problem of climate change, though they have few plans to do much about it (on this issue, the Republicans almost literally reside on a different planet). Meanwhile the Republicans’ reflex toward tribalism and division has the potential to turn social relations between America’s historically dominant European descendants and the nation’s various other ethnic groupings into a seething cauldron of hatred and violence.

But Democrats’ inability to provide a credible response to the zeitgeist of imperial decline could play into electoral defeat or failure either this time around or next. Trump offers a politics of isolationism and the image of the Strong Man, which may better fit the spirit of the times. True, any intention to “Make America Great Again”—if that means restoring a global empire that always gets its way, and whose economy is always growing, offering glittery gadgets for all—is utterly futile, but at least it acknowledges what so many sense in their gut: America isn’t what it used to be, and things are unraveling fast.

Troublingly, when empires rot the result is sometimes a huge increase in violence—war and revolution. The decline of the British Empire was the backdrop for World War I, which led to an even bloodier reprise a couple of decades later. Today the foreign policy establishment in Washington appears eager to pick a fight with Russia, and Hillary Clinton has a track record of dangerous interventionism (she’s won the endorsement of neoconservative hawks—both Republican and Democrat—who pushed for the Iraq invasion of 2003). Trump, for all his rhetorical belligerence, seems perhaps a bit less bellicose internationally, though his eventual foreign policies are currently about as easy to read as a Rorschach ink blot.

Russia’s Vladimir Putin is playing a peculiar role in the current contest. Trump and Putin have publicly complimented one another (one can only speculate as to the motives on both sides), while Hillary Clinton hews closely to the neocon-formulated State Department line that Putin is a dangerous strongman who threatens his neighbors. In fact, it is the US and NATO that have surrounded Russia with advanced weapons, reneged on agreements, and instigated regime change in Ukraine.

The Western powers’ ongoing provocation and demonization of Russia is pushing the world closer perhaps to nuclear war than was the case even during some decades of the Cold War. Against this frightening backdrop Trump has proposed (perhaps jokingly) that Russia hack Clinton’s emails. For her part, Clinton gives no indication that she will ratchet down the anti-Putin rhetoric; just the opposite appears to be in store—both during the campaign and the next four crucial years, when we are likely to face another (perhaps much worse) financial crisis along with escalating international tensions.

Could “we the people” handle a bit more of the truth? One would certainly like to think so. As it is, the US and the rest of the world appear to be sleepwalking into history’s greatest shitstorm (a somewhat more geeky and less scatological way to describe it would be as the mother of all Dragon Kings). Regardless how we address the challenges of climate change, resource depletion, overpopulation, debt deflation, species extinctions, ocean death, and on and on, we’re in for one hell of a century. It’s simply too late for a soft landing.

I’d certainly prefer that we head into the grinder holding hands and singing “kumbaya” rather than with knives at each other’s throats. But better still would be avoiding the worst of the worst. Doing so would require our leaders to publicly acknowledge that a prolonged shrinkage of the economy is a done deal. From that initial recognition might follow a train of possible goals and strategies, including planned population decline, economic localization, the formation of cooperatives to replace corporations, and the abandonment of consumerism. Global efforts at resource conservation and climate mitigation could avert pointless wars.

But none of that was discussed at the conventions. No, America won’t be “Great” again, in the way Republicans are being encouraged to envision greatness. And no, we can’t have a future in which everyone is guaranteed a life that, in material respects, echoes TV situation comedies of the 1960s, regardless of race, religion, or sexual orientation.

Bernie Sanders offered the best climate policies of any of the pre-convention candidates, but even he shied away from describing what’s really at stake. The times call for a candidate more in the mold of Winston Churchill, who famously promised only “blood, toil, tears, and sweat” in enlisting his people in a great, protracted struggle in which all would be called upon to work tirelessly and set aside personal wants and expectations. The candidates we have instead bode ill for the immediate future. Given the absence of helpful leadership at the national level, our main opportunity for effective preparation and response to the wolf at our doorstep appears to lie in local community resilience building.

It’s the truth. Can you handle it?

![[Power book cover]](https://richardheinberg.com/wp-content/uploads/2021/03/cover_POWERcatalog-proof_300x450.jpg)