The analytical arm of the U.S. Department of Energy now says the United States will become a major energy exporter in a few years. Will this eventually prove to have been an accurate prediction?

The forecast is contained in the Energy Information Administration (EIA)’s Annual Energy Outlook (AEO) for 2017, released on January 5th. In the publication’s Reference Case scenario, America is energy self-sufficient by 2026 and a net exporter thereafter.

Prominent news organizations have understandably reported the EIA forecast uncritically: after all, to question it might seem to require independent and sophisticated data analysis. Nevertheless, it should be noted that past AEO reports have erred, often spectacularly. A recent peer-reviewed study examined 630 renewable energy forecasts by the EIA between 2004 and 2014 and found that most sharply under-estimated solar/wind generation or capacity growth, and that the inaccuracy of forecasts has actually worsened in recent years. EIA’s projections also consistently overestimated the cost of renewable electricity.

To its credit, the EIA regularly publishes its own retrospective analyses in which it compares its previous forecasts with subsequent data. All one has to do is read a few of these “how’d we do?” analysis to confirm that the Annual Energy Outlook reports repeatedly over-estimate fossil fuel consumption and carbon dioxide emissions. The EIA also misses at forecasting oil prices. In 2005 the agency predicted in its Reference Case that oil prices would lie within the $25-$30 per barrel range in the years from 2010 to 2015, with gasoline prices staying at about $1.50 per gallon. Actual prices hovered around $100 per barrel for oil ($3.50/gallon for gasoline) for nearly three years during that period. In its “high oil price case” the EIA projected $48/barrel by 2025. But today $48 is considered a low price for oil—too low, indeed, for the industry to be profitable (and inflation doesn’t account for the hike in the industry’s break-even price). The EIA has also shown a consistent pattern of over-estimating coal consumption and electricity demand.

Sure, forecasting the energy economy is hard. But that’s just one more reason news agencies should accompany all EIA projections with warning labels.

With those caveats in mind, let’s take a quick look at what the EIA is predicting, and see whether it makes sense.

Oil

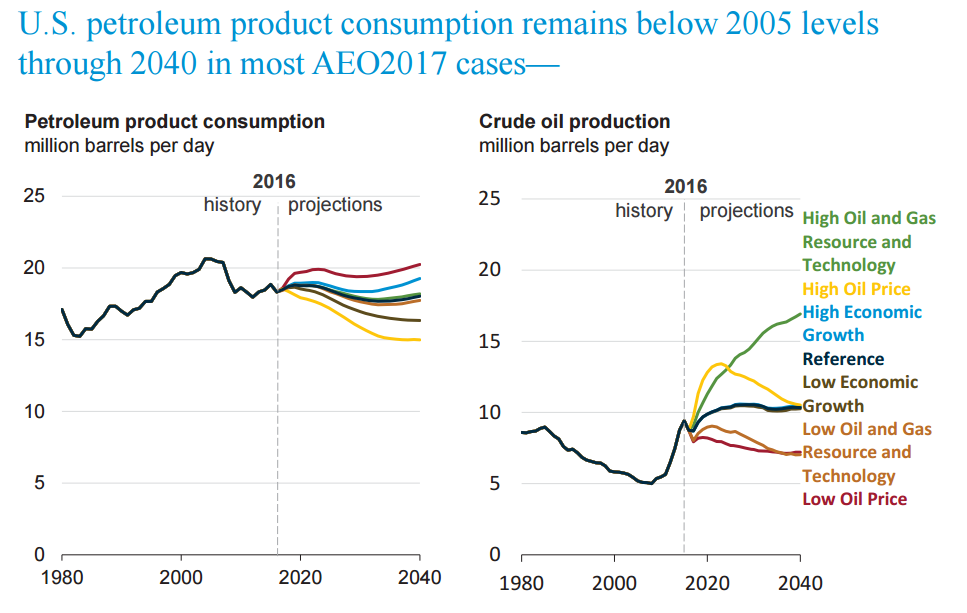

The AEO includes a Low Oil Price scenario, in which U.S. production slowly drifts downward to about 7 million barrels per day by 2040; a Reference Case, which has production sailing along at over 10 mb/d (higher than current output); and a High Resource and Technology scenario, which sees oil production soaring to about 17 mb/d—far more than any country has ever produced. The U.S. currently uses over 19 mb/d, so even if the High Resource and Technology scenario were to eventuate, the nation would likely still remain a net importer, depending on how oil demand evolves.

Source: U.S Energy Information Administration, Annual Energy Outlook 2017, p. 41.

There are several moving parts here, including: oil resources; oil prices; the health of the overall economy, which would impact oil demand and prices; and the prospect of new government policies (under the Trump administration and future administrations) that could facilitate oil production.

Oil resources are large; what matters is the size of the portion of those resources that can be recovered at a financial and energy profit. As the EIA acknowledges, the key to the growth or decline of future U.S. petroleum output lies with tight oil produced by hydrofracturing and horizontal drilling (conventional U.S. oil has been in decline for decades). Tight oil happens to be a subject that my organization, Post Carbon Institute (PCI), has assessed with independent and sophisticated data analysis. Earth scientist David Hughes, in his most up-to-date PCI report on U.S. tight oil, assigns recent EIA forecasts (especially for the Bakken play) a “very high optimism bias.” That’s a polite way of saying that, on the basis of the best available data, these forecasts have a very low probability of being borne out.

In order for U.S. tight oil production to significantly recover (it’s currently down by over 15 percent from its peak in 2015)—much less to grow to levels commensurate even with the more modest EIA forecasts—the industry desperately needs higher prices to incentivize much higher drilling rates. After all, for producers U.S. tight oil is some of the highest-cost oil in the world; that’s partly because continuously high rates of drilling are required, since individual wells deplete rapidly. The industry has suggested that cost-cutting efforts have made tight oil profitable at about $60 per barrel (roughly $7 higher than the current WTI price). But much of that cost cutting was due to high-grading (drilling only in the so-called “sweet spots,” which are quickly being exhausted), and to rate-cutting by oil services companies that rent equipment and expertise. High-grading is not sustainable, and whenever oil prices recover oil services companies will surely again demand higher rates. Therefore, we might also assign the industry’s profitability target of $60 a “high optimism bias.” Real profitability probably lies in the $100 range or above. But at that level oil prices impact the overall economy; one of the results is a reduction in demand, which leads back to lower prices. In other words, the petroleum market is in a situation characterized by systemic price volatility. The AEO deals with this momentous reality (which is whipsawing the oil industry and the economy at large) by simply ignoring it.

Technology continues to evolve (today a typical rig can drill more wells per unit of time than in the past), helping to lower drilling costs somewhat. However, Hughes’s analysis suggests that improvements in technology are reaching the law of diminishing returns after significant advances in 2010-2015, and that high-grading and reduction in service costs have actually played a larger role in reducing breakeven costs since the price plunge in 2014—and probably cannot be counted on to very substantially change oilfield economics in years to come.

What about Trump’s policies? An executive branch dominated by oil-friendly officials like Rex Tillerson and Rick Perry, together with a supportive Republican Congress, could rescind regulations and open up federal lands for exploration. But even major actions along these lines might do relatively little to alter oil company balance sheets now deeply in the red. Again, oil prices are the prime mover.

Strong climate policies seem highly unlikely to emerge at the federal level during the next four years; nevertheless, it’s worth noting that a hefty carbon tax or similar policy (whenever the U.S. might finally get around to implementing it) would likely favor electric vehicles, helping drive down oil demand and hence oil prices.

Taking all this into account, it appears that even the EIA’s Low Oil Price scenario may turn out to be highly optimistic. In almost any realistically conceivable instance, the nation will remain a significant oil importer.

Natural Gas

Hopes for the United States to become a “major energy exporter” realistically hinge almost entirely on prospects for much higher levels of production for natural gas. Prior to the shale gas bonanza of the past few years, U.S. natural gas production was in a slow but inexorable decline—but fracking made the U.S. briefly self-sufficient in gas and the world’s largest natural gas producer. Over half of the nation’s gas now comes from shale resources.

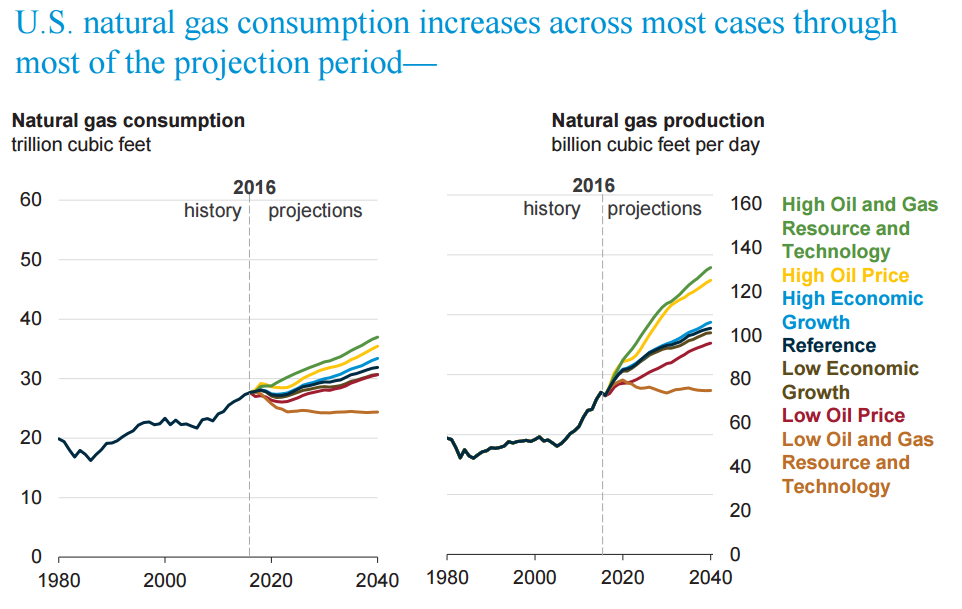

Source: U.S Energy Information Administration, Annual Energy Outlook 2017, p. 53.

In the EIA’s High Price scenario, natural gas production more than doubles by 2040, enabling very large export volumes. In the Reference Case, production increases by about a third. Even in its Low Resource and Technology scenario, the EIA projects U.S. gas production in 2040 as remaining at about its current level.

How realistic is any of this? David Hughes has been analyzing shale gas data carefully since 2011, documenting the rapid decline rates of shale gas wells and mapping possible and actual drilling sites. His 2016 Shale Gas Reality Check notes that “Actual shale gas production overall has declined by 4.7% since peaking in February 2016. All major shale plays have peaked and older plays, like the Barnett and Haynesville, are down 38% and 52%, respectively.” Yet each new AEO in recent years has increased its play-by-play estimates of future shale gas production, sometimes by as much as 60 percent. In other words, just as shale gas production rates have been slowing and beginning to decline, the EIA has doubled down on its “optimism bias.”

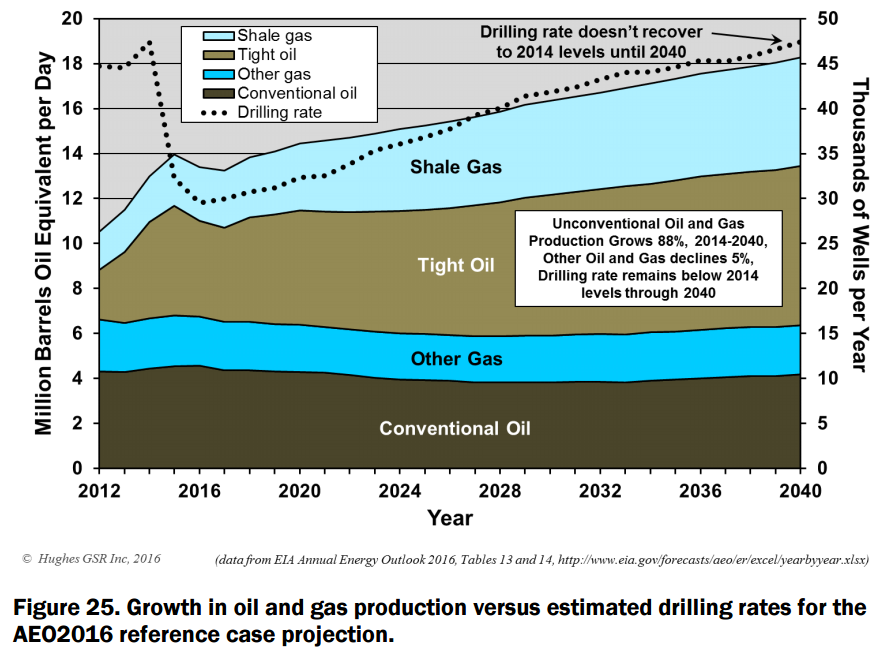

Again, prices are critical to understanding what’s going on, and where things will go from here. Just about everyone agrees that producers oversupplied the market in recent years, driving prices down to levels at which shale drillers were losing money on every cubic foot of gas they produced. Low interest rates helped drillers make up for negative free cash flow by enabling them to take on very large debt loads. Still, it’s truly remarkable how long the shale bubble kept inflating. But bubbles, by their very nature, eventually pop—and after they do, it can be hard to lure investors back. Hughes notes that “The EIA drilling rates in AEO2016 require a little over one million wells to be drilled between 2015 and 2040. At an average cost of $6 million each that represents an investment of $6 trillion.” Who is going to pony up such colossal sums without expectation of profit?

Higher natural gas prices would make more shale drilling profitable. And of course, the main reason for the U.S. to export natural gas (at least from the standpoint of producers) would be to take advantage of higher gas prices overseas, though that would force Americans to compete with consumers elsewhere, thus raising domestic prices. But higher natural gas prices would have economic impacts, one of which would be to reduce domestic demand. (In fact natural gas prices are not higher overseas, if one takes into account the $5 per thousand cubic feet that it costs to transport the gas by tanker.

American LNG export terminals are therefore a bad idea financially; their rationale hinges entirely on the accuracy of EIA reports like this one.)

Then there’s the bottom-line question: Are U.S. shale gas resources sufficient to realize the EIA’s production scenarios? Given per-well decline rates, the required drilling rates, the geographic variability in resource quality, and the number of possible well locations, Hughes is skeptical:

“My ‘very high’ optimism bias rating for the overall EIA AEO2016 reference case shale gas projections is based on the fundamentals given what is known from an analysis of well quality and production data from subareas within each play. A final note on this optimism is Figure 25 [below], which shows that the EIA assumes that production will begin to grow strongly starting in 2017, despite a 37% decline in drilling rate from peak levels in 2014. Tight oil and shale gas production are collectively forecast to grow 88% from 2014 levels to all-time highs by 2040, while drilling rates remain below 2014 levels to 2040, with only a modest increase in price.”

Source: J. David Hughes, 2016 Shale Gas Reality Check, Post Carbon Institute.

These remarks, published just weeks ago in response to AEO2016, are equally applicable to the EIA’s newly released AEO2017 report. Unless U.S. natural gas production increases very substantially above current (declining) levels, there will be no surplus gas to export. And it’s hard to see where that very substantial increase could come from.

Coal

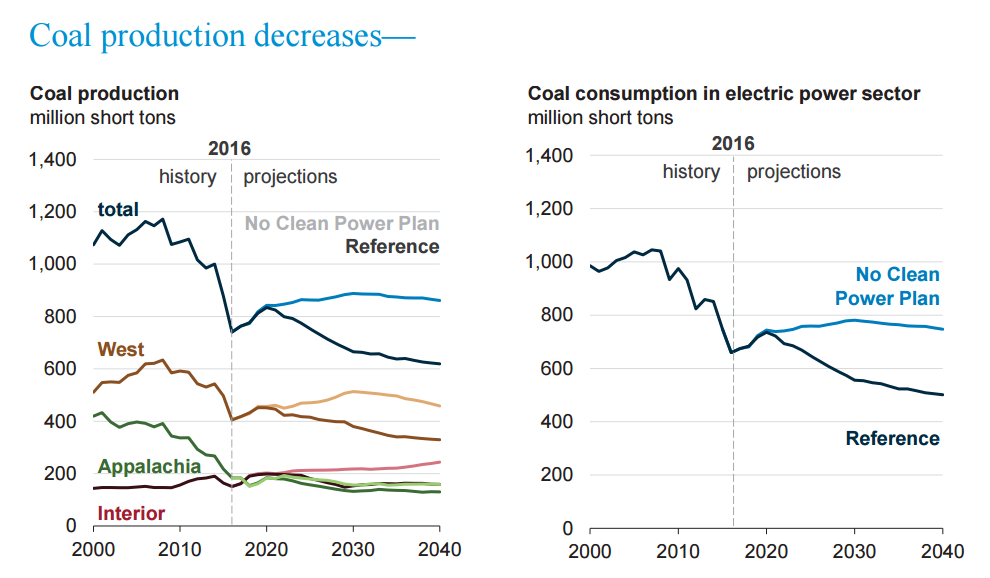

The EIA expects that coal production will continue a slow but gradual decline, falling 0.7 percent per year through 2050. Declining coal consumption is largely due to increased use of natural gas in domestic electricity generation.

Source: U.S Energy Information Administration, Annual Energy Outlook 2017, p. 83.

Assuming the trend of trading coal for gas continues, this would free up more coal for export. However, coal use is declining in other nations as well (notably the UK).

The U.S. is already a coal exporter (about 70 million tons per year—less than one percent of world consumption). But coal export capacity is limited, and so is the global market. While U.S. coal exports may grow somewhat over the short term, the longer-term trend is clear: the coal industry is dying. As noted above, this is partly due to a nearly worldwide move away from coal and toward natural gas and renewables for power generation. If natural gas prices increase greatly, this trend might reverse temporarily. But a comeback for coal would have to confront the fact that, as the best coals are mined, the industry is having to dig deeper and mine lower-quality resources, at higher costs. And the cost of electricity from renewables is falling fast. This is not a propitious economic environment for greatly boosting coal exports.

Other energy

The EIA has wind and solar power generation growing 3.5 percent annually in its Reference Case scenario. Of course, renewables may grow much faster than the EIA projects (as has happened consistently in recent years). But even in that case, the U.S. is not likely to become a major electricity exporter. Only Mexico and Canada are realistically possible recipients of surplus electricity. Canada currently exports significant amounts of hydro-based electricity from Quebec to the U.S., and is likely to continue doing so. Mexico currently imports gas and coal, so it could potentially import renewable electricity instead; but the likelihood that U.S. solar and wind power will grow at the rate that would be required for this to happen on a significant scale seems small indeed.

* * *

So, overall, how credible is the claim that the U.S. is on the verge of becoming a major energy exporter? Not very. In the most pessimistic scenarios cited in the EIA’s AEO2017 report, the U.S. remains a net energy importer. But as we have seen, even some of those most pessimistic scenarios probably suffer from high optimism bias.

The authors of the report should have included a scenario in which tight oil and shale gas production decline at rates commensurate with a realistic assessment of per-well decline rates, geographic resource variability, and numbers of possible drilling sites. Had it done so, the resulting chart would have shown the nation with declining overall oil and gas supplies. Net energy exports could not occur under such a scenario.

The timing of the release of AEO2017 is interesting. Typically the EIA publishes its AEO report later in the year; for example, it released the final version of AEO2016 in September. Could the agency be seeking to curry favor with the incoming administration, which is promising more energy production and exports? There’s no way to know, of course.

However, it seems likely that whatever optimism bias currently exists in the EIA will only increase under Trump/Perry stewardship. Already outgoing Energy Secretary Ernest Moniz has announced a new “scientific integrity” policy to deter the Trump administration from gagging or firing employees who worked on climate change and other controversial energy issues. It seems likely that pressure could likewise come to bear on energy supply analysts to hike their optimism to unprecedented levels.

In any case, we at Post Carbon Institute will continue to check the figures and provide an independent analytic voice.

Oil pipeline image via shutterstock.

![[Power book cover]](https://richardheinberg.com/wp-content/uploads/2021/03/cover_POWERcatalog-proof_300x450.jpg)