MuseLetter #278 / July 2015 by Richard Heinberg.

Download printable PDF version here (PDF, 113KB)

The articles in this month’s Museletter both come from my recent trip to Greece. First up is the text of the talk I gave at the conference on philanthropy and sustainability which was my primary reason for the trip. Following that is a diary of my experience of Greece, a country in crisis.

Sustainability Metrics, Growth Limits, and Philanthropy

As the metrics of sustainability become ever more robust and sophisticated, it is ever more apparent to many of us who study those metrics that industrial civilization, as currently configured, is unsustainable.

Ecological footprint analysis tells us that we are presently using 1.5 Earths’ worth of resources annually. We are able to do this only by drawing down renewable resources at a rate that exceeds their ability to regenerate; in other words, by stealing from the future.

Planetary Boundaries analysts have identified nine crucial parameters that define a safe operating space for humanity within the global ecosystem. We are currently operating outside that safety zone with regard to four of the boundaries. Exceeding just one boundary far enough, long enough, imperils both human society and the ecosystem on which it necessarily depends.

The most widely discussed of those boundaries is the planetary carbon budget. As we all know only too well, the CO2 content of the atmosphere now exceeds 400 parts per million—up from the pre-industrial level of 280ppm—and we appear to be well on our way to 450, 550, or even 650ppm, while climate scientists have determined that 350 ppm is the safe limit.

Those numbers, plus extinction rates, rates of ocean acidification, rates of topsoil erosion, and rates of deforestation, are the metrics of sustainability that tend to be most frequently discussed by environmentalists, and the alarming numbers being reported for these indices are certainly sufficient to support my opening assertion that current industrial society is unsustainable. However there are two other important metrics that have fallen out of fashion, largely because many people assume they measure society’s health rather than its vulnerability. One is human population growth. We all love humanity, but how much of it can the Earth support? World population stands at about 7.3 billion, and is on course to reach between 9 and 11 billion later this century. Yet a growing human population makes all those previously mentioned ecological perils—including climate change, deforestation, loss of biodiversity, and soil degradation—harder to address.

The other, even less fashionable metric of unsustainability is GDP growth, of which population growth is a component. As economies expand, their energy use rises, their greenhouse gas emissions increase, and their consumption of both renewable and non-renewable resources grows. Thus there tends to be an inverse relationship between the size of the economy and the well-being of the natural environment. Of course, there have been many efforts to decouple economic growth from ecological damage—by switching energy sources, by recycling, by banning the most harmful chemicals, by designing buildings and manufacturing operations to be more energy efficient, by regulating industrial practices of all kinds. And indeed it is possible to point to better or worse examples of economic expansion in terms of environmental impacts. Sometimes countries with high GDP are able to use their wealth to clean up local environmental damage and to outsource resource extraction and heavy manufacturing to poorer nations, whose air and water quality suffers as a result. On a global basis, however, the overall correlation still holds.

One of the key components of ecological discourse since the early 1970s has been the recognition that economic growth is, beyond a certain point, self-limiting. The Limits to Growth study of 1972 pointed out that our planet has finite resources as well as a finite capacity to absorb industrial wastes. As those source and sink limits are approached, various feedback processes within the economy itself are likely to lead to a reversal of the decades-long trend toward expansion, possibly accompanied by financial crashes—since our financial system depends so much upon returns on investments, which themselves require continued economic acceleration.

The “standard run” scenario from the Limits to Growth scenario series showed a peak and decline in world industrial output during the first half of this century, or right about now; indeed, many economists are today noting a slowing of growth worldwide (this is especially clear for the older industrialized countries—Europe, the United States, and Japan; however, it may also be the case even for the Asian “tigers,” principally China, which posted such dramatic expansion during the past two decades). Economist Larry Summers, former Chief Economist of the World Bank, discusses the current deceleration in terms of “secular stagnation,” attributing its cause to demographic or financial factors, including too much debt. However, it is hard to disregard the coincidence of the 43-year-old scenario study and the emerging reality. Ecological and biophysical economists have identified causal factors linking energy resource depletion and accumulating environmental impacts with the economic slowdown, reducing the likelihood that the coincidence is merely one of chance.

Many of us who have been part of the growth limits discussion have arrived at a common view of the situation that can be summarized as follows: Economic growth may not be entirely over, but its limits are indeed within view. However, societies have become systemically dependent on economic expansion to provide jobs, returns on investments, and government tax revenues. Policymakers have made no plans to respond to the end of growth because the economists whom they listen to refuse to acknowledge that environmental limits to growth exist. This puts us in a bind. Policymakers, including central bankers, seem to have no choice but to tromp on the accelerator of monetary policy to achieve growth at any and all cost, even as physical scientists warn that further expansion will imperil both the environment and the economy.

Nevertheless, policy options to achieve a deliberate and managed adaptation to the end of growth do exist. Understanding these requires that we expand our discussion of sustainability beyond the environmental factors already mentioned.

Post-Keynesian economists have argued that financial sustainability is undermined by societies’ accumulation of too much public and private debt, which tends to lead to financial crashes. A significant and sustained increase in the debt-to-GDP ratio is increasingly regarded as a warning sign. It is worth noting, in this regard, that a February 2014 study by the consulting firm McKinsey & Co. found that total global debt is up 40 percent since 2007 to $199 trillion. As a percentage of GDP, “debt is now higher in most nations than it was before the crisis” of 2008. On average globally, the ratio of total debt to GDP was (at the time of the study) 286 percent as compared to 269 percent in 2007. By the way, Greece’s government debt stands at 177 percent of GDP, which is a higher ratio than that of just about any nation except Japan. Meanwhile Greece’s total debt (public and private) to GDP ratio is a little over 300 percent, a figure exceeded by Japan, Ireland, and Portugal, and about on par with Spain, the Netherlands, and Belgium.

Of course, all debt becomes risky when there is no economic growth, because the means for repayment of debt with interest become problematic. On the other hand, growth in debt can, at least temporarily, help expand GDP: nearly all new money is today created through the issuance of debt, so if the economy is deflating, one temporary solution might be to rapidly expand debt. But how can this be done under the circumstances? If GDP is not growing, banks tend not to loan and businesses tend not to borrow, so debt expansion in that case can only be accomplished by governments and central banks, which become borrowers and lenders of last resort so as to restart growth and prevent a cascading debt default crisis.

Meanwhile historians and sociologists are now in broad agreement that very high levels of economic inequality are socially unsustainable, leading eventually to an erosion of the perceived legitimacy of governance institutions. Income inequality is measured by the GINI index, which represents the income distribution within a nation.

There are linkages among the metrics we have just surveyed. Increasing amounts of overall debt tend to worsen economic inequality, as interest is transferred from borrowers to lenders. Meanwhile, GDP growth—partly because it is tied to an increase in overall indebtedness—also tends to intensify economic inequality, unless governmental redistributive measures are put in place. We see these trends, for example, in China, where rapid GDP expansion has been accompanied by dramatic growth in overall debt and by an increasing GINI index.

The financial and social markers of sustainability—or unsustainability—when considered alongside the ecological metrics already mentioned would suggest the following policy options for addressing our current set of dilemmas: From a financial standpoint, it makes sense to cancel a great deal of public and private debt, despite the perceived affront to those who invested and loaned in the first place. To prevent bank runs and the proliferation of further debt, banks should be prevented from loaning more than the amount of their deposits. Substantial currency reforms, beyond the scope of this short talk, would be required—including the disaggregation of the functions of currency, and the creation of democratic and decentralized institutions for direct credit clearing. From a social perspective, this would be a good time for government to do all it can, for as long as it can, to guarantee the very basics to everyone (food, shelter, and work), while taxing wealth and high incomes in order to reduce economic inequality and therefore social instability. These recommendations are quite apart from, and in addition to, those that might aim to rein in environmental damage—including a more rapid shift toward renewable energy sources, the vigorous pursuit of energy efficiency, habitat conservation and restoration, and localization of economies and especially food systems so as to deal with the inevitable decline in availability of cheap transport fuel.

What would a sustainable, post-growth society look like, then, in terms of the metrics mentioned? It would have gradually falling population and GDP, but improving quality of life as measured by alternative indices such as the Genuine Progress indicator (GPI) or Gross National Happiness (GNH). It would have stable levels of biodiversity and falling levels of carbon emissions. It would have stable levels of debt managed through direct credit clearing, and a low and stable level of economic inequality as measured by the GINI index.

There is one other implication of the growth-limits discourse that is highly relevant to the subject of this conference. That is the meaning of the end of growth for philanthropy. Here we are confronted by a great irony: humanity is approaching a time when philanthropy will be more needed than ever, to address proliferating environmental and humanitarian crises. Yet our existing philanthropic model depends upon growth, via returns on financial investments. Can philanthropy survive in a post-growth economy?

Philanthropic foundations represent large pools of wealth that accumulated during the recent, decades-long, anomalous period of rapid economic expansion. In most cases, that wealth is being shepherded by individuals and groups driven by an ethical impulse, and guided by a humanitarian and often an ecological sensibility. How can wealth stewards do the most good under the circumstances?

Permit me to make two broad suggestions. First: Think systemically. Symptoms of environmental, social, and financial breakdown abound, and must be dealt with one by one as they arise. But in terms of helping society adapt to limits, the most bang for the buck will probably be gained from efforts that seek to fundamentally redesign systems—transport systems, food systems, communications systems, health care systems, financial systems, indeed the economy itself. These systems arose in their current forms during a century when the increasing availability of cheap, concentrated, and portable energy sources drove innovations in manufacturing and transport, and led to the creation of debt-based money systems and the consumer economy. As our global energy regime changes, and as growth wanes, these systems will come under worsening stress and will have to adapt. It is in the guiding of that adaptation that the greatest opportunities may lie, both for the proliferation of benefits and the prevention of harm.

Second: Don’t remain wedded to the traditional philanthropic model in which giving is tied to investment returns. If economic growth is ending, that means philanthropy must change. This is a crucial moment for civilization and for the survival of countless species. If we don’t get the adaptive process right during the next ten or twenty years, the accumulated wealth of foundations may evaporate without it having accomplished the good works it could have done.

Foundations, and the non-governmental organizations that depend upon them, understandably tend to focus on what might be called “easy sustainability”—projects that can achieve measurable results that look good on yearly reports. How many tons of carbon emissions have we prevented? How many acres of rainforest have we preserved? These are certainly worthy achievements, but sometimes they can cause us to lose sight of the deeper goal of systemic sustainability. Seeing and approaching that goal requires understanding sustainability in the most essential terms possible.

As a way of helping identify those essential terms, I’ve previously noted five axioms of societal and ecological sustainability. These are as follows:

1. Any society that continues to use critical resources unsustainably will collapse.

2. Population growth and/or growth in the rates of consumption of resources cannot be sustained.

3. To be sustainable, the use of renewable resources must proceed at a rate that is less than or equal to the rate of natural replenishment.

4. To be sustainable, the use of non-renewable resources must proceed at a rate that is declining, and the rate of decline must be greater than or equal to the rate of depletion.

5. Sustainability requires that substances introduced into the environment from human activities be minimized and rendered harmless to biosphere functions.

To these we might add two axioms of financial and social sustainability:

6. To be sustainable, a financial system must generate only as much debt as can realistically be repaid; given that the tendency is for debt levels to increase anyway, periodic “jubilees,” or occasions of general debt forgiveness, are advisable.

7. To be sustainable, complex societies must find ways to limit inequalities of wealth, which might otherwise increase to the point where those with the least no longer regard governance systems as legitimate.

We are obviously very far from meeting those first five conditions of environmental sustainability. Nevertheless, even if our society—the most complex in history largely because it has found ways to exploit its environment far more intensively—is poised for a process of contraction and simplification, we still have choices. Shall we minimize suffering and destruction by deliberately slowing and downsizing, or accelerate until we hit the wall? The metrics of sustainability—including alternative economic indicators, such as GPI and GNH, as well as environmental indicators such as rates of species loss and atmospheric carbon indices—can help us if we listen with open minds and hearts. They can guide us as we redesign systems to reduce the need for energy and resource inputs, to reduce environmental impacts, to reduce perceived unfairness, and to promote better quality of life in the face of reduced material consumption.

As long as government is enthralled by the cult of growth, philanthropic foundations will remain among the only entities in society with the power and the flexibility to think outside the box—that is, with the courage and imagination to act in terms of a long view of societal sustainability that is not tied to the next quarter’s profits or the upcoming election. But to do this, philanthropy must be aware of its own box and find ways to tear down the walls that obscure a realistic view of the limits and opportunities before us.

What would this imply in practical terms? Perhaps it would mean supporting the work of organizations that promote a systemic, rather than just a piecemeal understanding of sustainability; and supporting demonstration projects that offer new directions for systemic adaptation—ways of providing food, transportation, health care, financial services, and other necessities in ways that are deeply sustainable.

It is probably not within the capability of philanthropic foundations to avert all the human impacts that will accompany the end of economic growth, nor the environmental impacts of past growth. Nevertheless, the strategic application of some of society’s accumulated wealth toward solving the problem of systemic adaptation to the end of growth could reduce immediate human suffering and leave more of our global ecosystem intact for future generations. That is certainly a worthy goal.

Greece Diary

I was in Greece from June 23 through July 5, and, while I had no meetings with government officials that might give me insider information on how events there are likely to unfold, nevertheless the experience was both enlightening and disturbing, and is worth relating.

Travel to Greece came at the invitation of the Stavros Niarchos Foundation, which had organized a conference on philanthropy and sustainability. The Foundation constitutes the largest philanthropic organization in the country and from what I can tell it is doing remarkable work in helping the people of Greece deal with their ongoing economic crisis. Stavros Niarchos has spent $100 million so far on jobs-creating projects in technology innovation and cultural preservation, and has promised another $200 million for the years to come.

Since Stavros Niarchos generously offered to pay for a plane ticket for my wife Janet too, we decided to celebrate our 20th wedding anniversary by seeing some sights—which in Greece inevitably includes ruins—and spending some much-needed tourist dollars.

Over its long history, Greece has certainly seen spectacular ups and downs, with its better moments providing the cultural underpinnings of western civilization. Sitting and strolling among the fallen pillars of the Acropolis and the Agora—where Socrates, Plato, and Aristotle hung out with their respective flocks of disciples, drinking the ancient equivalent of espresso while discussing truth, beauty, and good governance—couldn’t help but put me in a philosophical mood. These ancient people built in stone and inscribed their ideas on tablets. Yet how fragile their achievements proved to be in the face of economic decline and the onslaughts of invaders. In comparison, our vastly greater modern material achievements (thanks to the power of fossil fuels) have been expressed in buildings with an average 50-year life expectancy, and with writings preserved on media that reliably self-destruct in practically no time at all. What will we leave behind?

But I didn’t travel 6800 miles just to bemoan the fate of industrial society in general terms; I can do that perfectly well from the comfort of my home office. I wanted to see first-hand what’s going on with the Greek economic crisis. Janet and I arrived in the country just as the banks closed, and left the day of the national referendum. The situation there is complicated (for an excellent overview, read Brian Davey’s essay) and evolving so quickly that what I’m writing now might seem dated as soon as it’s published. Nevertheless, readers may find a few first-hand impressions helpful.

For tourists, Greece holds few hardships. Throughout our visit, ATMs were still dispensing wads of 50-euro notes—which we needed as restaurants and hotels gradually stopped accepting credit card payments. But for Greeks themselves, these are increasingly hard times. They face not just the practical inconvenience of being limited to withdrawing a maximum of 60 euros per day from their accounts (if they can find an ATM that still has cash), but also the business nightmare of maintaining credits and payments with banks shuttered, as well as the psychological burden of knowing that things are likely to get much worse, and soon. Greece’s economy has shrunk by 25 percent in recent years as a result of the global economic slowdown and the austerity measures insisted upon by its creditors; I would guess that it has contracted by at least another ten or fifteen percent in just the past two weeks.

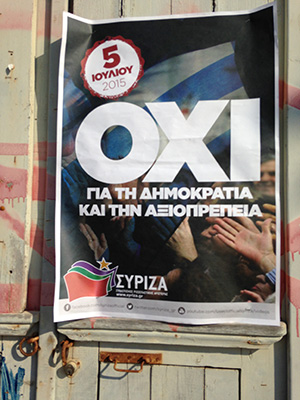

Naturally, I was interested in gleaning opinions from cab drivers, hoteliers, and waiters wherever we stopped. Business owners tended to favor a “yes” vote in the referendum (basically a vote of no confidence in the bargaining position of the socialist Syriza governing party, and a plea to remain within the eurozone regardless of the cost). But most ordinary Greeks we spoke to in Athens planned to vote “no” (“oxi” in Greek) as a show of support for Syriza and a thumb of the nose to the Germans, who are insisting on further austerity. As it turned out on Sunday, the “no” votes predominated, with more than a 60 percent majority.

That has infuriated the Germans and the central bankers, but the vote actually resolves nothing. The ancient Greeks spun the myth of Scylla and Charybdis, illustrating a requirement to choose between two unacceptable options; modern Greeks are living that myth. If they accept further austerity, it will just mean more unemployment and another crisis in a few months. If the debt is “restructured” by giving the Greeks longer to pay, a little more time can be purchased—but another crisis remains inevitable. Even if Syriza prevails in negotiations and much of the nation’s debt is cancelled (everyone knows the Greeks can’t pay it), that guarantees no happy ending. The nation’s pension system is too generous to be sustainable and Greece will simply run up more deficits—and the government needs an infusion of cash now if catastrophe is to be averted; that means more debt. Exiting the euro and bringing back the drachma would entail the loss of a substantial portion of the value of savings. Wealthy Greeks, who already keep most of their money in offshore accounts, might leave altogether.

Any way you look at it, the people of Greece are headed toward misery. And you can see it on their faces. Early in our trip, we would occasionally be approached by old women in peasant garb (possibly immigrants) seeking to sell us little pocket-sized packages of tissue for a euro apiece. By the end of our journey, some of the tissue-sellers were young and well dressed. We spent a couple of days on the gorgeous island of Hydra, where there are no cars (luggage is transported by donkey). Even there the good-natured Greeks we encountered were long-faced. We tried to express our commonality by saying, “However it goes, we wish you the best; after all, it could be our country next.”

In the end, this is an end-of-growth dilemma. If Greece’s economy were still expanding at its 1990s rate, there is at least a chance that the government could repay its debt. But that kind of growth is now unachievable. And as the whole global economy sputters, it is nations like Greece, which live largely from tourism and import all their oil, that will likely confront growth limits first.

Lurking in the background is the immigration question. Refugees from political chaos in the Middle East, and from worsening African poverty, have fed rapid population growth in Athens (and Istanbul as well). Immigration has boosted GDP in some ways (wealthy Syrians relocating to Istanbul have driven up property values), but it has also led to the requirement for more investment in schools, roads, and other infrastructure, and hence more borrowing to finance such projects. This is a problem for Europe as a whole, but it’s the entry points (Turkey, Greece, Italy, and Spain) that bear the brunt. No doubt European nations situated further north would like a firewall against this tide of immigrants, which can only expand as the century wears on. One articulate Italian gentleman living in Greece, whom we spoke with at length over a delicious dinner at an Athenian taverna, speculated that an unspoken subtext of the debt crisis might be that Germany is willing to see Greece—and maybe eventually another country or two—exit the euro, and perhaps the European Union as well, so as to create a failed-state buffer region to either absorb or discourage the immigrant influx.

What should the Greeks do? That’s hard to say, and it’s up to them in any case. If, as it now seems, the design of the eurozone was fatally flawed from the outset, then Greece might as well make its exit now. There’s speculation that Greek Prime Minister Alexis Tsipras may be playing his hand in such a way as to force Germany to push Greece out of the euro; this would play well to his domestic constituency, which has come to see the Germans as villains of the scenario. Meanwhile many people in Germany continue to view the Greeks as lazy and Tsipras as incompetent—characterizations that are more than a little simplistic. My guess is that a Grexit will indeed occur soon, and that will mean many more weeks of chaos and uncertainty for the Greeks and for the rest of Europe as well.

Greece offers an opportunity to study the challenges and opportunities of the end of economic growth for those in the “developed” world. But it’s more than a historic test case; Greece is a nation of 11 million people who face real hardship. Wish them well; you might be next.

![[Power book cover]](https://richardheinberg.com/wp-content/uploads/2021/03/cover_POWERcatalog-proof_300x450.jpg)