MuseLetter #311 / April 2017 by Richard Heinberg

Download printable PDF version here (PDF, 125 KB)

The End of Growth, Seven Years Later

I wrote The End of Growth in the months following the Global Financial Crisis of 2007-2008 (the book was published in North America in 2011), with the goal of helping to put that crisis in proper perspective. I argued that persistent economic growth is not “normal” in either an ecological or a historical frame of reference, and that a major threat to the continuation of growth (such as was posed by the 2008 crisis) is best interpreted as a signal that the global economy is approaching inevitable growth limits as the larger ecological systems of which it is a part become depleted, degraded, and destabilized.

This is not an entirely new way of thinking about the economy. Starting in the 1960s, Nicholas Georgescu-Roegen, Kenneth Boulding, and Herman Daly laid the foundations for an economics that correctly situates human society within the context of Earth’s limited natural energy flows and resource stocks. In 1972, the landmark study The Limits to Growth argued that the rapid global economic expansion that began in the twentieth century would almost certainly end and reverse itself in the twenty-first due largely to resource depletion and pollution. These have remained minority views among economists for decades; however, I argued that they are well founded, and that we are now seeing the confirmation of Limits to Growth warnings.

However, three things have changed since The End of Growth first appeared in North America. There are clear signs that growth is becoming more difficult to achieve worldwide. Impacts from slowing growth are appearing in the social and political spheres. And both analysts and grassroots social movements are starting to regard growth as the cause, rather than the solution, to worsening ecological and social crises. Let’s explore these developments one by one.

Signs that growth has run its course. This book argues at some length that ongoing, annual global GDP growth is very nearly finished. However, the years since the 2008 crash have seen some semblance of “recovery,” in that growth, as conventionally measured, has revived. Is the book’s thesis thereby refuted? I would argue to the contrary. The effort required to achieve the “recovery” was truly astonishing. Trillions of dollars, euros, and yuan were created and spent by central banks to prop up the global financial system. More trillions were called into existence through government deficit spending. Some analysts point out that, in the U.S. at least, during the decade since 2008 the dollar amount of cumulative government deficit spending has exceeded the dollar amount of GDP growth.

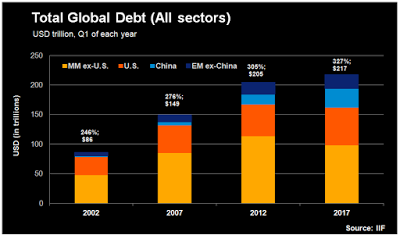

Government and central bank efforts to forestall collapse effectively piled more debt onto a system already drowning in debt (the world total debt level, at $180 trillion, is higher now than before the 2008 crisis, and is approximately 300 percent of world GDP). As I argue in Chapter 2 (extrapolating the analysis of economists Hyman Minsky and Irving Fisher), the accumulation of debt, undertaken in order to generate wealth and economic expansion, is subject to the law of diminishing returns, and is likely to end in a massive de-leveraging event—as has occurred in similar situations throughout history. A new book by business strategist and financial consultant Graham Summers calls our current situation The Everything Bubble, in that when the government bonds that serve as the foundation of our current financial system are in a bubble, all risk assets (everything in the financial world) is effectively a bubble too. Thus efforts contributing to the “recovery” since 2008 did not solve our underlying economic problems, but only hid them; the end-of-growth reckoning was not canceled, only postponed. There have been no significant reforms to the financial system or efforts to reduce society’s reliance on unsustainable debt. The “recovery” was therefore merely a temporary reprieve, and we should not fool ourselves into thinking that it can be replicated or extended much further.

Meanwhile, fundamental non-financial system dynamics are also leading toward economic contraction. As discussed in Chapter 3, the costs of climate change continue to soar. In 2017, the total bill for climate related disasters in the US alone was $306 billion—not enough to tip the economy into recession, but far above the $46 billion cost for the previous year. However, these disaster costs do not include the snowballing economic consequences of shifting weather patterns and declining biodiversity. Even if GDP growth can still be achieved in these circumstances, it is, to use a term coined by Herman Daly, “uneconomic growth,” in that it reflects or creates a decline in overall quality of life.

In the book, I discuss the accumulating impacts of fossil fuel depletion. In recent years, many energy experts have adopted the view that fossil fuel resources are large enough that depletion poses no economic threat to society. However, it is important to remember that industry harvests coal, oil, and natural gas using the low-hanging fruit principle. Thus the resources being extracted today are generally more expensive and difficult to access than those recovered decades ago. This higher-cost trend is accelerating, even though it is not yet fully reflected in fossil fuel prices or total production levels. One symptom of the trend is the declining profitability of the oil industry. During the past four years, the five largest oil companies were unable to pay for new investments and dividends without selling assets or taking on more debt; in 2017, according to FactSet, the companies spent $31 billion more than they generated from operations. Smaller companies that specialize in production of U.S. tight oil, using hydrofracturing and horizontal drilling, are in an even worse bind. In 2017, two-thirds of U.S. tight oil was produced at a financial loss. The oil industry’s only hope for profitability is higher prices—but higher prices would undercut demand for petroleum and eat away at economic growth. Meanwhile, global oil discoveries have declined to the slowest pace since 1947. And evidence suggests the current tight oil and shale gas boom in the U.S. will be short-lived, due to the limited size and highly variable quality of geological reservoirs. Altogether, depletion is posing a fast-accelerating challenge to the viability of the fossil fuel industry—which, for the past two centuries, has been the key to industrial society’s expansion.

Could the challenges to economic growth posed by fossil fuel depletion be overcome through a shift to renewable energy source? In 2015-2016, I worked with David Fridley of Lawrence Berkeley National Laboratory to explore the likely opportunities and constraints involved in a hypothetical societal shift to all-renewable energy. We found that such a shift would entail massive restructuring of energy end use (in transportation, manufacturing, food systems, and building operations) that would likely match the required investment in energy generation infrastructure. We concluded that the only way to make such a shift affordable and practically feasible over a relatively brief time (three or four decades) would be to reduce overall energy usage substantially, especially in high-use countries such as the United States. Doing so would likely be incompatible with GDP growth.

Social and political impacts from slowing growth. After decades of falling food and energy costs as a percentage of GDP, those costs stabilized and started growing at the start of the new century. Then came the financial crisis of 2008. Now, despite a decade of “recovery” following that crisis, not everyone is feeling the joy. Most of the increase in wealth and income since 2011 has gone to the top one percent of earners—the investor class, which is in position to benefit from government and central bank policies designed to shore up the financial system. Wages and salaries as a share of total GDP have fallen by about 5 percent since 2000, while corporate profits, rents, and interest income have increased by about the same percentage. As a result, the majority has seen gradual erosion in quality of life. This erosion is felt especially by the young, women, people of color, and those with few marketable skills. A consumer confidence report by the University of Michigan in March 2018 showed that, for the first time since such surveys have been undertaken, Americans younger than 35 are less optimistic about the economy than older Americans. This unease appears well-founded: research by Stanford economist Raj Chetty and colleagues has found that about 90 percent of Americans born in the 1940s earned more than their parents by the time they turned 30, while only about half of those born in the 1980s can say the same (figures were adjusted for inflation and household size).

Americans are feeling more anxious, depressed, and dissatisfied with their lives than they did in 2009, and happiness, or what researchers call “subjective well-being,” is declining among those surveyed in a detailed study by the Gallup Organization and the healthcare information service Sharecare.

Increasing inequality and declining future prospects are recipes for social unrest, political polarization, and the rise of populist or authoritarian politicians. Since 2008, authoritarian regimes have become more numerous, according to the Democracy Index compiled by “The Economist” magazine. The Democracy Index report for 2017 “records the worst decline in global democracy in years. Not a single region recorded an improvement in its average score since 2016, as countries grapple with increasingly divided electorates. Freedom of expression in particular is facing new challenges from both state and non-state actors. . . .”

The trend toward authoritarian leadership is most glaringly apparent in the United States, a nation now listed by the Index as a “flawed democracy.” Donald Trump gained election in 2016 promising to “Make America Great Again”; his electoral strategy centered on pitting one social-ethnic group (citizens of European-American heritage) against others (immigrants, African-Americans, and Latinos), while demonizing his political opponents. These tactics echo those of historic and emerging authoritarian politicians in Europe, The Philippines, and elsewhere.

Post-growth or De-growth analysts and movements. Increasing numbers of people regard the rapid global economic growth seen in the past few decades as metaphorically cancerous, since it was purchased at the expense of resource depletion, waste generation, and pollution, with severe impacts on global natural life support systems. Economic inequality has worsened and quality of life is crumbling. Growth of this sort has to end, voluntarily or otherwise.

Indeed, it’s become clear to many climate researchers and other environmental scientists that addressing climate change, resource depletion, and the biodiversity extinction crisis requires deliberately shrinking the economy. For example, British scientist Kevin Anderson of the Tyndall Center for Climate Change Research estimates that staying under the agreed-upon 2 degree Celsius ceiling for global warming in a way that allots poor countries their fair share of the carbon budget would require rich countries to reduce emissions by 10 percent per year—which would be incompatible with economic growth in those nations. And a new study in the journal Nature Sustainability concludes that:

[N]o country [currently] meets basic needs for its citizens at a globally sustainable level of resource use. Physical needs such as nutrition, sanitation, access to electricity and the elimination of extreme poverty could likely be met for all people without transgressing planetary boundaries. However, the universal achievement of more qualitative goals (for example, high life satisfaction) would require a level of resource use that is 2–6 times the sustainable level. . . . [O]ur findings suggest that the pursuit of universal human development, which is the ambition of the SDGs [Sustainable Development Goals], has the potential to undermine the Earth-system processes upon which development ultimately depends. But this does not need to be the case. A more hopeful scenario would see the SDGs shift the agenda away from growth towards an economic model where the goal is sustainable and equitable human well-being. [emphasis added}

Meanwhile, biologist E. O. Wilson has suggested that the only effective way to counter the biodiversity extinction crisis is to reserve half the world’s land and sea area for other species. It is difficult to imagine this happening in the context of continued economic expansion.

New economic thinking has contributed to recent discussions about how to understand and adapt to the end of growth. Post-Keynesian economists, such as Steve Keen, argue that conventional economic theory has two fatal blind spots. One is that an overly large private debt to GDP ratio can cause deflation and depression; the other is that energy is key driver of production (in conventional economic theory, the role of energy is barely considered at all). Without a proper understanding of debt, custodians of the financial system have no way to avoid periodic debt deflation events; and without an understanding of energy’s crucial role in the economy, conventional economists are unable to properly explain the ultimate source of growth and are therefore clueless about a primary growth limit.

The End of Growth discusses hopeful new initiatives and social experiments that could help society adapt to a post-growth regime. These include alternative economic arrangements such as the sharing economy—which is much more widely talked about today than when the book first appeared (and has also come in for some criticism); likewise the idea of a universal basic income.

Transition, a post-growth social movement discussed in Chapter 7, continues to expand, having spread now to over 50 countries, with thousands of groups in towns, villages, cities, universities, and schools. Its projects include promoting local food, local renewable energy, local investment, and local currency; some groups have opened repair cafes and tool libraries as ways of reducing consumption. Likewise, the degrowth movement in Europe, also discussed in Chapter 7, continues to broaden its appeal. In 2017, for the first time ever, a political party—the Five-Star Movement in Italy—successfully ran on a platform that included mention of degrowth. In the wake of that victory it seems particularly appropriate that an Italian language edition of this book will be published later this year.

* * *

The End of Growth may have appeared a few years ahead of its time. After all, the years 2012-2017 saw an increase, rather than continued fall, of U.S. and global GDP. The optics, as they say, were not good for the book’s central claim. But was its warning really premature? After all, the point of warnings is to convince people to alter behavior so as to avert harm or to pre-adapt to coming change. Harm and change of the kinds described in the book are no less certain today.

In the long run, we really won’t have any option other than to adapt to limits. The rapid economic growth the world witnessed in the twentieth century was a one-time-only phenomenon resulting from scientific research, technological development, advertising, consumer spending, and borrowing; crucially, it was ultimately fed by depleting, non-renewable fossil fuels—primarily petroleum. We are now living at the tail end of that era.

Politicians and conventional economists continue to call for more growth. This is, to use a tired and ugly metaphor, beating a dead horse. Belief among the general public in the possibility and benefit of further economic growth is eroding. And the harder we push human systems toward growth limits, the further and faster those systems will snap back as limits are exceeded. Whatever growth remains to be wrung from the system will come at the cost of future generations and the rest of nature, and will likely continue to disproportionately benefit the already wealthy. Those who hold their hands on the levers of national public policy, large corporations, and even philanthropy are missing end-of-growth signals because they are the only ones still benefiting from continued growth.

The next cyclical recession may be just around the corner. After the last one, the global economy was patched together with metaphorical hairpins and chewing gum. The next is likely to be much worse, as central banks and governments have already deployed most of their ammunition. The end of growth has been postponed as long as is humanly possible. It’s far past time to come to terms with ecological reality and make a deliberate transition to a post-growth regime.

Image: End sign, via Unsplash

![[Power book cover]](https://richardheinberg.com/wp-content/uploads/2021/03/cover_POWERcatalog-proof_300x450.jpg)